We know that when you are thinking about buying yourself that dream car, you can become a little blinkered. Sometimes all you can think about is how great it is going to be driving that expensive new car around and how good you are going to look doing it too.

People often tend to be unrealistic about the kind of budget they can afford. We really want you to get that car that you have wanted for years but we also don’t want you to end up bogged down with repayments you can’t afford and debt that stops you from taking that holiday you desperately need. So to keep that from happening we have made this little guide to help you set a budget and give you some handy tips on how to save a bit of money here and there.

Monthly Repayments and Outgoings

First thing’s first, monthly repayments. Before you even factor any other driving costs into the budget you need to be able to afford these. It may seem self explanatory but if you have £1000 a month spare after paying rent and bills that does not mean you have £1000 to spend on a car per month. Using 95% of your monthly pay on car repayments and living off an industrial sack of rice for a month really is no way to live!

When setting a monthly repayment budget it is very important to make a realistic budget of what you spend on bills (water, electricity, gas, phone bill, etc.) and what you spend on food a month. This way you can be sure that what you have left over will be a safe and realistic amount that you can use as your overall car budget. You can use our Loan Affordability Calculator to help with this. You can also use our car finance calculator to see what your monthly payments could be based on the amount you wish to borrow and your credit circumstances.

Top tip: There are certain bank accounts that will allow you to make money back on your spending on bills and your food shopping. For example the Santander 123 Current Account. As long as you have these set up as direct debits you will get money back just for paying your bills. It’s worth checking out other credit card account benefits, because there are some really great perks to be had by people who do their research!

Road Tax

Image Credit: TaxRebate.org

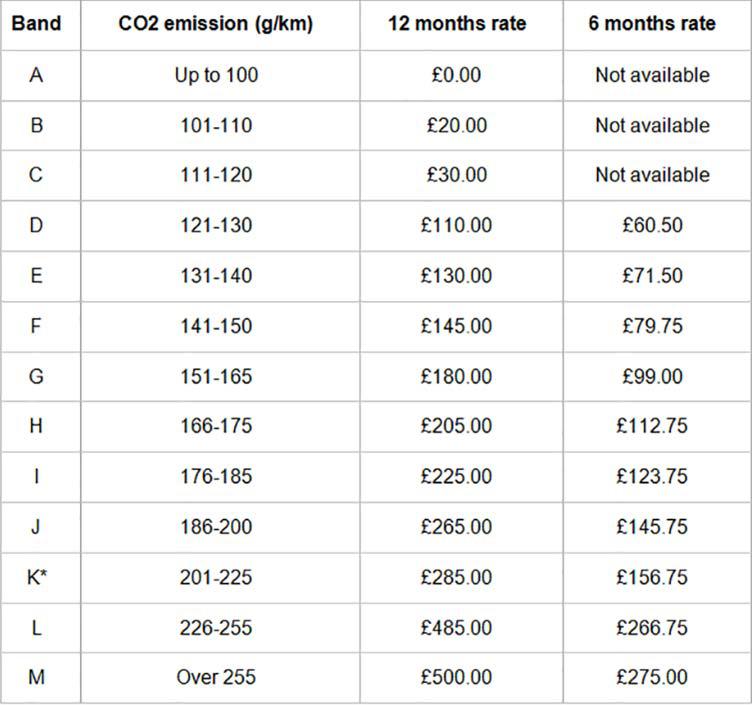

Taxing your vehicle is another unavoidable cost that you will need to factor in to your budget. It is important to remember that you must have insurance on your vehicle to actually be able to tax it. There are three ways to pay your road tax: 12 months, 6 months or monthly direct debit. Each have their individual benefits, but for the lowest cost the monthly direct debit is the winner.

The amount of tax you pay depends on the emissions produced by your car. Typically the fuel efficiency will be better on a lower emission car, so a money conscious car buyer will keep this in mind when choosing their vehicle. The more efficient your car, the more money you will save on tax and therefore you will have more to spend on other things.

Below is the standard tax table for cars registered on or after 1st March 2001.

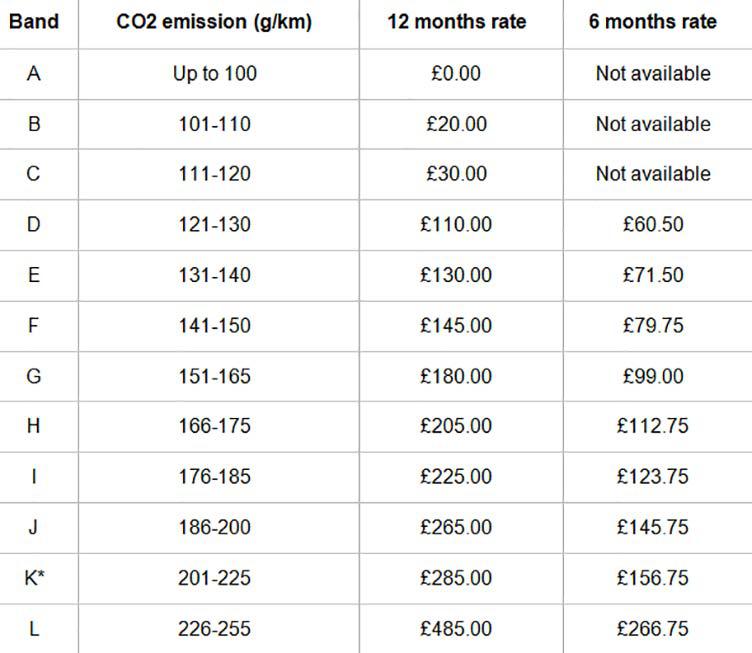

Below is the first year tax rate for vehicles registered on or after 1st April 2010. This is the rate you will pay for your first year of tax if your car was registered on or after the above date. After the first year the rate will return to the amount stated in the previous table. Note: There are currently discussions over dramatically increasing the tax on diesel cars. Whilst nothing has been set in stone, the push towards cleaner air will have affect diesel cars the most.

As you can see the vehicles in tax band A don’t have to pay anything at all. Cars in this band include electric cars and hybrids such as the Toyota Prius, Vauxhall Ampera and Nissan Leaf, plus fuel-efficient diesels including the Ford Fiesta and Audi A1 1.6 TD.

Car Insurance

Image Credit: Pictures of Money

Insurance is another significant cost that you are going to have to factor in to your budget and you have to have it, don’t think you can go saving money by not paying for insurance because you will get in all kinds of trouble. If you were to get caught by the police whilst driving uninsured you could face a £100 fixed penalty, have your car impounded or destroyed and even face court prosecution with a maximum fine of £1,000. Even if this were not the case, it would not be sensible to drive anywhere without it. There is no way of knowing whether you may have an accident and be left with no way of paying for your car repairs.

You can pay your insurance in one big chunk as a yearly payment or if you would rather you can split it up and pay it month by month, although this will end up costing you a bit more. Which ever way you decide to pay you are going to need to budget the money in somehow, either by saving a certain amount each month to pay off the year in one go or factoring in a portion of your monthly budget to pay via the monthly route. If you are confident managing your finances, you can use a 0% interest credit card to pay the insurance cost. You can then pay this off monthly, meaning you do not have the extra cost that paying monthly direct to the insurance company incurs.

It is definitely worth using one of the many insurance comparison tools out there to find the best deal for you, have a play around with some of the options available to see what kind of price you can get. Don’t forget to check with the companies that aren’t on those sites like Directline and Aviva.

The aspect that is going to affect how much you pay for insurance the most will be which car you choose. Cars all fit into certain insurance groups, the higher the insurance group the more you will have to pay for your insurance. Things that affect the insurance group are: Cost of damage to parts, value of a new car of that model, body shell availability, time it takes to repair, performance of the car, security. So think about these things when you pick which vehicle you would like because it will affect your insurance group.

Top tip 1: Tweaking your job title can save you a decent amount of money, we certainly are not saying lie about your job but, for example, ‘builder, ‘’brick layer’ and ‘construction worker’ all sound like very similar jobs but they all have different insurance rates. So when you are sorting your insurance out, just have a little experiment, without going too far, and see what kind of difference you can get.

Top Tip 2: Adding additional experienced drivers to your policy can actually save you a lot of money. As long as you remain the primary driver and the person you added has a good driving history you are likely to save some money.

Top Tip 3: Use comparison websites to find the deal, do not buy through them. Contact that particular company directly and you will find you avoid some of the commission these comparison sites charge.

Fuel

Oil prices are very low at the moment, meaning it is costing a lot less at the pump than it has been over the past few years. In general, supermarkets have the best prices compared to other petrol stations. If you have a clubcard or nectar points, you can also save a little extra money every time you fill up, provided its at a petrol station affiliated with the reward scheme. There are also apps available that can point you towards the cheapest petrol stations in your area.

Avoiding motorway petrol pumps is another way to reduce on costs. Because they tend to be the only readily available petrol station, the prices are far higher. If you are desperate for a refuel, you may want to (safely) check your mobile for the nearest supermarket. Sometimes they can be quite close to the motorway off ramps, so if you don’t mind adding a little more time to your journey, you can save money.

Obviously the best way to save money on fuel is to plan your journeys in advance. Getting lost or stuck in congestion can waste a lot of fuel. By having planned and prepared your trip, you can avoid any unnecessary wastage.

Servicing

Unexpected repair costs can completely ruin your budget. Whilst you can’t prepare for every breakdown, having your car regularly serviced could help you spot any potential problems on the horizon. Establishing a relationship with a mechanic you can trust will be a big help going forward. Using them regularly will mean you can probably get away with asking them a quick question or even having a glance at your car. You won’t normally be able to do this with a large national chain.

Fixing your car yourself is also a cheaper option – unless you don’t know what you’re doing. Only attempt a repair job if you are certain you know what you are doing. If in doubt, ask a friend or family member with a bit of knowhow to help. Online guides and videos can also be helpful, provided you do a bit of research to find a trusted source.

Budgeting For Your Car

We hope this very brief collection of tips on how to budget has helped. You can find all kind of tips and advice on credit and money in general in our Help and Advice section and our Credit Clinic.

Facebook

Facebook Twitter

Twitter Instagram

Instagram LinkedIn

LinkedIn Youtube

Youtube