Before you take out any sort of finance package, it’s a good idea to try and find out just how much the package will cost you. Hire purchase car finance deals are no exception. Even though monthly payments are fixed, it’s useful to know just what you could afford with your budget, or what sort of package is available based on your credit score.

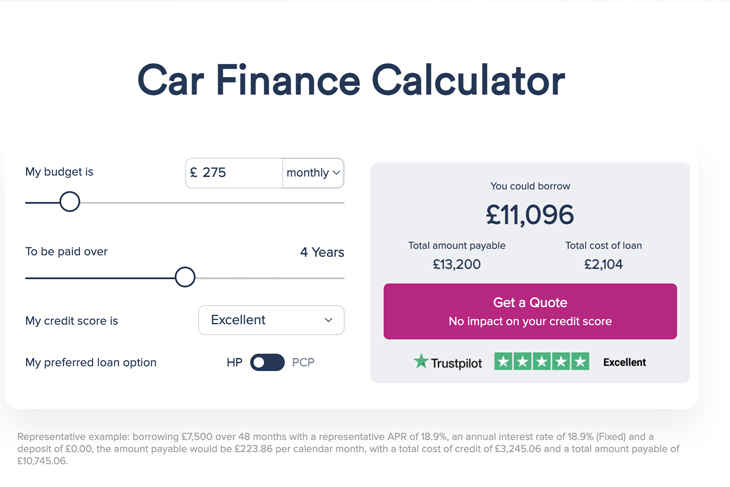

Creditplus’s car finance calculator lets you look at a hire purchase package before you apply. Here’s how the calculator works.

Budget

The first thing the calculator asks you is what your budget is. This is the amount of money you can spend on a car finance package each month, but you can also set it to be the total budget you want to spend – ideal if you know the exact make, model or even car you want to purchase.

It’s important that you are realistic when it comes to the budget, so sit down and work out all your regular monthly ingoings and outgoings. Be honest with yourself, as you want to ensure that your monthly repayments on the car finance package will not put you into any difficulty.

Duration

The amount you will pay for a car finance package will vary depending on how long you take it out for. The shorter the duration, the less interest you will pay. But you will be facing higher monthly repayments, unless you have a large deposit. Have a play with the duration to see how it changes based on length of time, and you’ll quickly get an idea of how long you should set the duration of your finance package.

Credit score

Next, the calculator asks you for what your credit score is. You can find this out using one of the numerous credit check websites online. Your credit score will affect the interest rate offered by finance providers. The better the score, the lower the interest rate.

If you don't know or haven't the time to find out, simply select what you believe it might be. As a first step this will give you some idea of what to expect - once you apply with us we can find out on your behalf and provide you with a more accurate result.

What you could borrow

Once you have inputted the information into the above, you will be provided with a summary of what you could borrow. It’s broken down into three sections.

The first is the total amount you could borrow across the length of the agreement. The second shows the total amount payable, which is the amount you borrow plus the total interest you would be charged. The final figure shows exactly how much the interest rate could cost for your loan package.

Get a quote

Now that you have an idea of what you could be offered, you can proceed and get a more detailed quote. Remember, getting a quote will not impact your credit score. When you apply with some finance providers, quotes are recorded on your file and can lower your score, especially if you’ve been looking around for a good deal. With Creditplus, there’s no impact on your credit score.

The quote will take into account more information about you and your finance status, as well as what sort of deposit or part exchange you might have available. You’ll then be provided with a list of quotes from finance companies based on your circumstances. There’s no obligation to accept one of these quotes, so it’s a good way to see exactly what you could be offered should you want to go ahead with a deal.

Are You Ready to Save on Car Finance?

If you’re considering getting a new car, then you don't want to miss out on what Creditplus can offer. Applying with us will not affect your credit profile, so why not complete a quick application now.

Apply Online Today!See our latest car deals

Facebook

Facebook Twitter

Twitter Instagram

Instagram LinkedIn

LinkedIn Youtube

Youtube