When you are looking to buy a new car, you want to have as many different options available to you as possible. If you know that you have a bad credit rating, you may think obtaining a car loan is not an option. But you may be surprised to hear that bad credit car finance is not only available, but also that prices and rates are much more competitive than you might expect. In the first of a new series, Creditplus Answers, we take a closer look at bad credit car finance and how it works.

Not everyone has good credit

Shortly after the 5p plastic bag charge came into effect I was walking into Tesco car park. I suddenly realised that I didn’t have a plastic bag and that I would have to pay the charge, cursing myself for not remembering. As I was thinking this, someone in a brand new BMW i8 drove past. I looked at the car and wondered if the driver was worried about the plastic bag charge too?

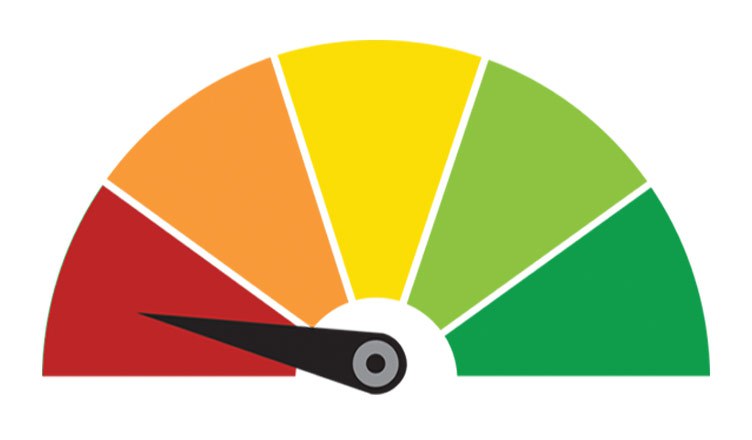

Not everyone can afford to drive a BMW i8. That doesn’t mean they shouldn’t be able to drive a nice car. Managing money and debt is a large part of modern life, and not everyone is going to be able to keep their credit score perfect. With so many little things that can affect your credit rating, very few people manage to obtain and maintain an excellent credit rating. Our figures show that roughly 70% of customers who apply for us are classed as sub or non-prime. With so many of our customers having a credit history that isn’t perfect, then it was a no brainer for Creditplus to provide a bad credit car finance solution. So how does it work?

Bad Credit Car Finance from Creditplus

When you apply for car finance with Creditplus, we conduct what’s known as a soft credit search. This means that we take a look at your credit file without conducting a full search. Why is this important? A full search is recorded on your credit file. When finance providers look at your file, seeing a full search on your file can be a warning sign that you are potentially a risk, as if you apply and are rejected then this isn’t a good sign of your credit status. Unfortunately, if you have a bad credit rating, the chances of you being rejected for finance are higher. So you are caught between a rock and a hard place. Do you only apply for car finance with a company that is guaranteed to accept you first time, often at extremely unfavourable rates, or do you give up on finance and hope you can save enough money to buy direct. With Creditplus, our soft credit search lets us take a look at your status without affecting your file. Using our car finance comparison system, we can then look across our wide panel of lenders to see if there is a suitable lender for you. That way, we can quickly compare all the finance options available to let you know exactly what we can offer.

Creditplus compare over 90 lending options to find a finance package suitable for you. We have specialist lenders that cater for different credit ratings, so even if you think your credit rating is abysmal, we still may be able to help. Although you won’t have access to the headline rates of APR that customer’s with an excellent credit rating are offered, spreading the cost of your car across manageable monthly payments will get you access to a nice car without having to save up for months and months. Buying a newer car can also cut costs when it comes to fuel, insurance, road tax, and even trips to the mechanic. Important considerations that you have to factor into car buying.

Is car finance right for me?

It is down to you to decide if bad credit car finance is the right option. Only you know your monthly expenses and outgoings enough to make this decision. If you have bad credit, you may already be taking steps to repair your file and so feel more confident about obtaining finance. Bad credit car finance is an option being taken by more and more consumers across the UK. If you are considering your car buying options, car finance should not be ignored. You might be surprised at just what’s available to you when you apply.

Useful links

To work out just how much you might need to spend on a bad credit car finance package, visit the Creditplus car finance calculator. Here you will be able to calculate monthly payments, APR and total cost of finance based on your credit rating, term length, amount you wish to borrow and size of deposit.

Still not feeling confident about your finances? Then visit the Credit Clinic for a more detailed look at credit ratings, what causes a bad credit rating, and steps you can take to start repairing your file. There is also a detailed resources page that links to debt advice charities that can provide real help and guidance if you are struggling.

Credit Clinic

Useful Resources

Ready to apply? Complete our car finance application form and receive a decision on your finance options. Just fill in your details and one of our customer advisors will be in touch to talk you through your car finance options.

Start your car finance application

Have a question you want answered? Send your car finance questions to us and we’ll feature them in a future Creditplus Answers. Either post a comment below or message us at our facebook or twitter accounts.

Facebook

Facebook Twitter

Twitter Instagram

Instagram LinkedIn

LinkedIn Youtube

Youtube